So yesterday, the Federal Reserve, decided to keep interest rates at a historical low to keep the economic stimulus of 0% interest rates alive (a.k.a. free money). I feel so strongly against what is happening under the guise of monetary stimulus that I needed to dust off the old blog and write something about it.

- The Federal Reserve is a PRIVATE institution with unknown investors that receive a preferred 6% dividend on “profits” and is NOT audited.

- The Federal Reserve as founded in 1913, the same year that marked the beginning of end of the Gold Standard around the world and marked the real start of fractional reserve banking.

- The Federal Reserve was created to “provide the nation with a safer, more flexible, and more stable monetary and financial system.” It’s emergence allowed the safe, flexible, and stable funding of multiple wars, defense spending, and corporations.

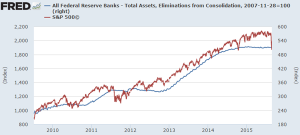

- From the financial collapse in 2008 til today, a super dovish monetary policy has been put in place to try to stimulate the economy: 0% interest rates for qualified borrowers (banks and large corporations), QE via direct purchases of debt collateral, and possibly even direct open market operations and manipulation of equities and derivatives were the tools being used.

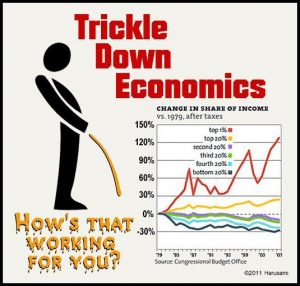

Since 1913, this monetary hypothesis of trickle economics via central banking and monetary policy have been tested. Supposedly, making money available to banks and corporations at a low cost will directly translate into more jobs, higher incomes, a stronger economy and country, and betterment of the American Dream. As of today, we finally have the results of that experiment and the statistics are not good. In the beginning, it seemed like a good idea and much of the hypothesis did some positive affirmation under specific circumstances. However, we are now testing the edge cases and in this scenario, it seems to break down miserably at creating a stable financial system while exacerbating wealth inequality. Here’s some of the recent stats.

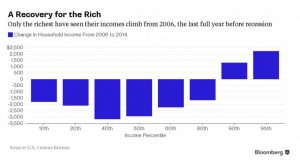

0% interest rates and quantitative easing have only benefited the incomes of the top 15% of the country.

Trickle down income inequality is soaring.

Wealthy individuals are getting artificially richer due to a manipulated stock market.

Layoffs drive the price of stocks up, benefiting shareholders and punishing employees.

Leveraged buybacks further increase stock prices while not creating any economic value.

Folks, this is the country that we live in today. The one where we are taught that US Treasuries are “Risk Free” financial instruments and that markets are “free” and not manipulated. Instead what I’m seeing is an obvious and grotesque redistribution of wealth that most people cannot understand and therefore are oblivious to. The next steps in this complex financial scam are a ban on cash, negative interest rates, lower welfare and social benefits, and higher taxes. Thus completing the construction of a financial prison where the masses serve the few rich elites who own all the assets.